What is FUTA Tax on IRS Form 940?

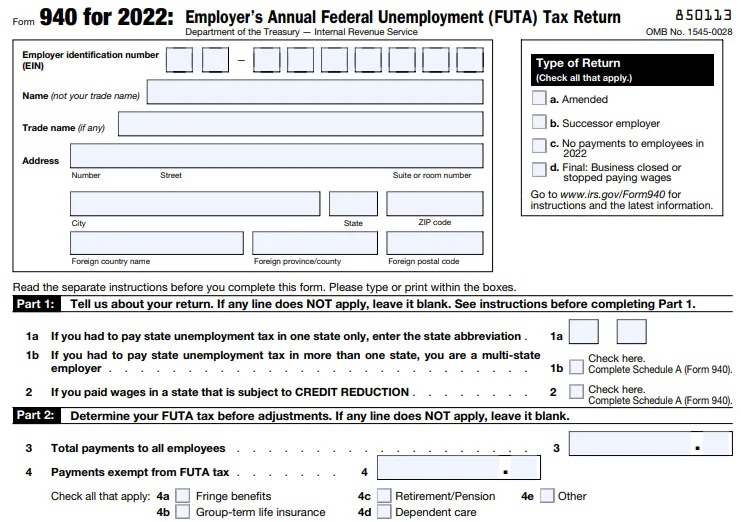

IRS Form 940 is Employer’s Annual Federal Unemployment (FUTA) Tax Return which is filed to report unemployment taxes.

FUTA- Generates funds to compensate people with unemployment benefits who have lost their jobs. This tax applies to the first $7,000 paid to each employee during the calendar year. Employers must pay a FUTA tax rate of 6% on the first $7,000 of wages that each of their employees makes. However, if employers pay and report state unemployment taxes on time, they will receive a tax credit of 5.4%, effectively reducing the

FUTA rate to 0.6%

What are the changes in Form 940 for Tax Year 2023?

The IRS has released a few changes to Form 940 for the Tax Year 2023. These are as follows:

| Credit reduction states for 2023 | |

|---|---|

| California (CA) | 0.6% |

| Connecticut (CT) | 0.6% |

| Illinois (IL) | 0.6% |

| New York (NY) | 0.6% |

| U.S. Virgin Islands (VI) | 3.6% |

Electronically filing an amended Form 940:

Beginning sometime in 2024, the IRS expects to make filing an amended Form 940 electronically.

When to File Form 940 online for 2023

Form 940 due date for the 2023 tax year is January 31, 2024.

If FUTA taxes were deposited on the correct deadlines, you have until February 10, 2024, to File Form 940.

E-file Form 940Information Required to File

Form 940 Electronically

Business Information

- Business Name

- Employer Identification Number (EIN)

- Address

FUTA Tax Details

- FUTA Tax and Adjustments If credit

reduction is applied. - Balance Due or Overpayment

- FUTA liability deposits

With this 940 instruction you can easily E-file 940 to the IRS.

Exclusive Features to File 940 Online

Comprehensive features to make your tax filing experience hassle-free.

Form 940 Schedule A

Use this when required to pay SUTA in more than one state, or paid wages in any state are subject to credit reduction

Form 940 Schedule R

CPEOs and Section 3504 agents approved by the IRS under section 3504 use this to file tax return

Built in Error check

Catch your mistakes before filing! Our IRS-authorized filing software enables you to catch mistakes before they cost you.

Form 940-V Payment

If you have a balance due? With Form 940-V, we can automatically generate the voucher for a check or money order.

Bulk Upload Template

Use the bulk upload template to file multiple returns and reduce the time taken to manually upload your data to File Form 940.

94x Online Signature PIN

TaxBandits offers 94x online signature PIN for Free. Apply through TaxBandits and easily return your 940.

Our US-based support team is standing by to help you file 940.

View More FeaturesSteps to File Form 940 Online?

Just register for your free account and follow these steps to file 940 online:

- Choose “Form 940” and tax year

- Enter employer details

- Review the Summary Form 940

- Pay and transmit the completed Form to the IRS

What is a Credit Reduction State?

A state that has not repaid money that it borrowed from the federal government to pay unemployment benefits is considered a credit reduction state.

Timely payment and reporting of SUTA taxes helps reduce the FUTA credit below 5.4% for these states.

Credit Reduction States

| States | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|

| California (CA) | 0.0% | 0.0% | 0.3% | 0.6% |

| Connecticut (CT) | - | - | 0.3% | 0.6% |

| Illinois (IL) | - | - | 0.3% | 0.6% |

| New York (NY) | - | - | 0.3% | 0.6% |

| U.S. Virgin Islands (VI) | 3.0% | 3.3% | 3.6% | 3.6% |

| California (CA) | 0.6% |

| Connecticut (CT) | 0.6% |

| Illinois (IL) | 0.6% |

| New York (NY) | 0.6% |

| U.S. Virgin Islands (VI) | 3.6% |

Form W-9: Request for Taxpayer Identification

Number and Certification

Invite your vendors to complete and e-sign W-9

Form W-9 is an IRS tax form used by an individual or entity to request a person's name, address, Taxpayer Identification Number (TIN) and certification from a hired contractor or vendor to e-file the 1099 information returns. IRS Form W9 is known as Request For Taxpayers Identification Number and Certification Form.

With TaxBandits online portal, employers can request form W9 online and manage all W-9 forms at one place securely. Sign up now and request the first FIVE Form W-9 for FREE.

Contact Us

As the e-filing for file940.com is provided by our sister product TaxBandits, TaxBandits dedicated US-based support team is available to assist you Monday-Friday, 9am to 6pm EST. You can call them at (704)684-4571, chat, or email them at support@TaxBandits.com